News

Gov. Ododo Inaugurates Advanced Security Drones, Vows Zero Tolerance for Criminality in Kogi

The Kogi State Government has unveiled two (2) newly procured high-capacity PH20 security surveillance drones as part of a sweeping strategy to strengthen surveillance, intelligence gathering and rapid response against criminal activities across the state.

Speaking at the unveiling ceremony held at the 12 Brigade Headquarters, Chari-Maigumeri Barracks, Lokoja, on Monday, Governor Ahmed Usman Ododo described the acquisition as a strategic and deliberate step rooted in his administration’s governing philosophy of firm leadership, territorial control and zero tolerance for criminality.

Governor Ododo described the acquisition as a deliberate and strategic move anchored on his administration’s philosophy of firm leadership, territorial control and zero tolerance for criminality. He said the drones reflect the government’s resolve to make the protection of lives and property its foremost priority.

According to the governor, the PH20 drones are equipped with advanced surveillance and monitoring capabilities that allow them to operate in difficult terrains, penetrate forest hideouts and support real-time, intelligence-led operations. He explained that the technology would enhance early detection of suspicious movements and improve coordination among security agencies.

Governor Ododo reiterated that his administration would not negotiate with bandits, kidnappers or terrorists, insisting that Kogi State would not surrender any part of its territory to criminal elements. He stressed that government, not criminals, must remain in control and assured that the state is prepared to confront and defeat all forms of insecurity.

He noted that the drone deployment sends a strong signal to criminal groups taking advantage of Kogi’s strategic location as a gateway between the North and the South.

The governor said his government studied emerging threats, including the displacement of criminals into forests and border corridors, and responded with decisive action.

Reviewing security achievements over the past two years, Ododo said the state has built a robust, intelligence-driven security framework combining technology, community participation, inter-agency collaboration and political will.

He described Kogi as the most peaceful state in the North Central zone, with a clear ambition to become the safest in the country.

The governor highlighted grassroots security measures such as the establishment of security structures in all 239 wards, the absorption of 2,752 vigilante personnel into the civil service, recruitment and equipping of hunters across the 21 local government areas, sustained clearance operations, and the creation of a Quick Response Unit supported by patrol vehicles, motorcycles and protective equipment.

Ododo expressed sympathy with victims of criminal activities and assured residents that the government remains firmly in control. He thanked President Bola Ahmed Tinubu and national security leaders for their support, commended the state’s security team and community actors, and urged citizens to cooperate with security agencies, declaring that Kogi State is unsafe for criminals but a secure home for law-abiding people.

Earlier, the Commander, 12 Brigade Nigerian Army, Lokoja, Brigadier General K.U. Sidi, described the deployment of the drones as a game changer, noting that it places Kogi State at the forefront of security innovation and operational efficiency.

In his address, the Chief of Army Staff (COAS), Lt. Gen. Waidi Shaibu, commended the State Government for setting the pace in security innovation, adding that the drones would enhance intelligence, surveillance and reconnaissance operations and further strengthen ongoing military and security efforts across the state.

The COAS, represented by Maj-Gen. Olusegun Abai, praised Governor Ododo for demonstrating strong commitment to complementing federal security initiatives, noting that the recent deployment of the 21 Battalion, alongside the new drone assets, would expand troop reach and enable decisive action against terrorists, bandits and other criminal elements.

He described the PH-20 drones as a force multiplier aligned with global best practices in modern warfare, linking the initiative to President Bola Ahmed Tinubu’s national security agenda.

The Army chief called for sustained cooperation between federal and state authorities, urged residents to support security agencies with timely intelligence, and formally unveiled the drones as a new chapter in Kogi State’s drive to secure its territory and neighbouring areas.

The event, which drew senior military officers, heads of security agencies, and community leaders, marked a significant boost to the state’s security architecture.

News

₦86.8bn Cashew Revenue: Okai Urges Kogi Govt. to Focus on Farmers’ Welfare, Not Just Statistics

…..“Don’t count billions while farmers burn in poverty” — Okai

The recent flag off of the 2026 Cashew Production and Marketing Season by Governor Ahmed Usman Ododo of Kogi State has sparked controversy about the State Government’s projection of ₦86.8 billion revenue from cashew production within the next four months.

A Political activist, Comrade Usman Okai Austin in a statement on Friday described the projection as proof that cashew farming has become a “goldmine” for the state, but said the same cannot be said of the real producers who remain trapped in poverty, exposed to risks, and abandoned by policy.

He noted that, “celebrating figures without securing farmers’ welfare is a dangerous illusion”.

“The Governor’s ₦86.8 billion target confirms that cashew is big business,” Okai said, “but the interest of the real farmers is conspicuously missing. Without concrete protection, these figures are nothing but beautiful speeches.”

Okai lamented years of systemic neglect that have left cashew farmers vulnerable to farm fires, arson, lack of credit, and predatory middlemen.

According to him, the absence of a government-backed safety net has forced many desperate farmers to sell off their cashew trees at giveaway prices, mortgaging their future for survival.

“When disaster strikes, farmers are on their own. No loans, no insurance, no intervention. The state must urgently establish a zero-interest loan scheme to free farmers from exploitation,” he demanded.

Describing farm fires as a recurring nightmare, Okai said farmers often lose entire lifetimes of investment in a single afternoon due to negligence or criminal acts.

“It is unacceptable that farmers can lose everything overnight with no compensation. The government must introduce a robust agricultural insurance framework. We should not only ask what the state can get from farmers, but what the state can do for them.”

While welcoming the government’s plan to establish cashew processing facilities, Okai issued a stern caution: don’t site them far from the farming communities.

“Processing, packaging and branding are crucial, but these plants must be located where cashew is grown. Moving them away will alienate farmers, raise logistics costs, and kill local jobs. Real development happens at the source.”

Okai further challenged the state government to come clean on how the expected ₦86.8 billion will be utilized, insisting that transparency is non-negotiable. He stressed that reinvestment must reflect in rural infrastructure, especially roads linking farms to markets and processing hubs.

He listed several critical routes demanding urgent attention, including:

Ogbabo–Abocho–Ajiolo Road

Sharia Bridge Axis

Gboloko–Oguma Road

Iyale–Ogane Nigu Road

Abocho–Adiyele Road

Anyigba–Adiyele Road

Ibaji–Idah Corridor

Egumeh–Ogbogodo Road

According to him, without functional roads, the cashew boom will collapse under transportation bottlenecks.

Okai concluded with a powerful warning, urging the government not to reduce hardworking farmers to mere statistics for revenue propaganda.

“Farmers must eat the fruit of their labour. There must be a clear, urgent communication channel between the state and the real farmers. Otherwise, the system will continue to enrich a few while the backbone of this industry is shortchanged.”

As Kogi positions cashew as its next economic jackpot, Okai’s intervention has ignited a critical debate: will the cashew billions uplift farmers—or bury them deeper in neglect?

News

Alleged Kogi Fraud: Witness Narrates How Kogi IRS Paid Over ₦1bn as Commission

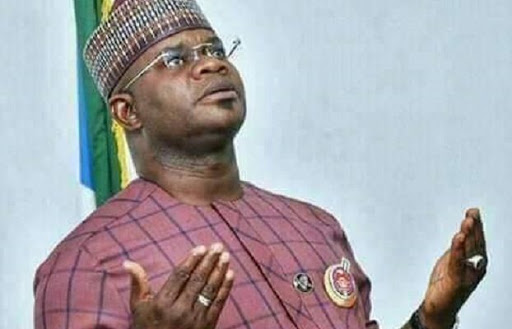

The trial of former Kogi State Governor, Yahaya Adoza Bello, continued on Friday, January 16, 2026, before Justice Maryanne Anineh of the Federal Capital Territory, FCT, High Court, Maitama, Abuja, with a prosecution witness narrating how the Kogi State Internal Revenue Service, KIRS, allegedly paid over ₦1.16 billion as “commission” into a Sterling Bank account belonging to one Philip Kumar within eight months in 2019.

The witness, Prosecution Witness 9 (PW9), David Ajoma, a compliance officer with Sterling Bank, told the court that the payments, which spanned from January to August 2019, were followed by consistent and heavy cash withdrawals, a pattern he described as unusual based on banking standards.

Bello is standing trial alongside Umar Shuaibu Oricha and Abdulsalami Hudu on a 16-count charge bordering on criminal breach of trust and money laundering to the tune of an alleged ₦110.4 billion.

At the resumed proceedings on Friday, lead prosecution counsel, Kemi Pinheiro, SAN, informed the court that the matter was for the continuation of evidence by PW9, who appeared pursuant to a subpoena. The witness was then led in evidence by Pinheiro.

Pinheiro referred the witness to Exhibit AD1, a statement of account earlier admitted in evidence, and drew his attention to transactions between March and August 2019. PW9 confirmed the transactions and, upon being asked to summarise inflows within that period, stated that a total of ₦963,803,717.38 was paid into the account from the Kogi State treasury.

When asked about withdrawals from the same account, the witness told the court that ₦835,904,000 was withdrawn in cash within the period under review.

Continuing, Pinheiro directed the witness to earlier entries on the statement of account, specifically inflows in January and February 2019. PW9 identified inflows of ₦99,593,761.81 on January 8, 2019, and ₦101,533,384.94 on February 7, 2019, both with narrations indicating Kogi State Internal Revenue Service.

Asked to do a cumulative summary of all payments made as “commission” from January to August 2019, the witness said: “From the exhibit, Kogi State Internal Revenue Service paid a total of ₦1,164,959,568.13 as commission within eight months in 2019.”

On total cash withdrawals between January and August 2019, PW9 told the court that ₦953,404,000 was withdrawn in cash.

Pinheiro further asked whether there was a consistent pattern of cash withdrawals on the account, to which the witness replied in the affirmative.

He was also asked whether the withdrawals usually occurred shortly after inflows from Kogi State Government-related accounts.

“Yes, my Lord,” the witness answered.

The prosecution then asked PW9 to state the balance on the account as of December 31, 2018. He responded that the balance stood at ₦212,264.29.

Asked, as a banker, to give his professional opinion on the pattern of withdrawals, PW9 said: “As a banker, there is a consistent pattern of withdrawals.”

At this point, counsel to the 1st and 2nd defendants, J.B. Daudu, SAN, raised an objection, which Justice Anineh overruled.

The prosecution pressed further, asking the witness whether he was familiar with suspicious transactions in banking practice. PW9 answered in the affirmative. He was also asked to explain the concept of a Suspicious Transaction Report (STR) and relate it to the evidence before the court.

PW9 explained: “A suspicious transaction report is filed when a customer’s transaction pattern is not consistent with the nature of the customer’s business or previous transactions. In other words, it is filed for individuals who carry out cash transactions exceeding ₦5 million and ₦10 million for corporate entities, in line with CBN regulations.”

Asked about his findings from the statement of account, the witness said he observed “multiple cash withdrawals, with the maximum single withdrawal being ₦10 million.”

However, when asked whether Sterling Bank filed any STR in respect of the account, PW9 said he did not have that information readily available.

Pinheiro then directed the witness to examine the statement of account between July and December 2018, prior to the alleged commission inflows. PW9 confirmed that there were no inflows into the account between July and December 2018.

He also confirmed that during that period, cash withdrawals were minimal. According to him, withdrawals included ₦700,000 in July, ₦500,000 on July 4, ₦500,000 on July 12, ₦150,000 on August 17, ₦200,000 on September 13, and ₦1,000,000 on December 10, 2018.

When asked whether there was any withdrawal above ₦1 million within six months prior to the inflows from Kogi State Government accounts, the witness replied: “No, as seen from the statement of account.”

Pinheiro further asked whether the pattern of withdrawals between July and December 2018 was the same as that between January and August 2019.

“No, it was not the same,” the witness responded.

Explaining the earlier period, PW9 said withdrawals before January 2019 were largely online transfers, unlike the heavy cash withdrawals recorded in 2019.

Under cross-examination by J.B. Daudu, SAN, PW9 told the court that he had been with Sterling Bank for three years and was serving as a compliance officer, having joined the bank as an experienced hire.

Asked whether he had the account opening package for the account in question, the witness said he did not. He admitted that without the account opening documents, he could not identify the signatories, directors, or the nature of the business associated with the account.

He also agreed that he could not determine whether the business was seasonal or whether the transaction pattern was consistent with the customer’s line of business. He confirmed that his testimony was limited strictly to the contents of Exhibit AD1.

Daudu further asked him to confirm the narration of the inflows identified as coming from Kogi State Government or KIRS. PW9 said the narrations indicated “Kogi State transfer” and “KIRS transfer,” but added: “I do not know what it means.”

On February 2, 2019, the witness said the narration read “commission for January 2019 – Kogi State Internal Revenue Service.” He admitted he did not know the difference between Kogi State Government and Kogi State Internal Revenue Service.

He further agreed that he could not tell whether the funds belonged to the customer or how the customer chose to spend them, whether by cash withdrawal or online transfer.

He also confirmed that there was no record before him showing when the business relationship between Kogi State Government and the account holder commenced.

According to him, “When there is money, there will be consistent withdrawal; when there is no money, there will be consistent no withdrawal.”

When asked whether all the inflows were withdrawn solely by Philip Kumar or if there were other beneficiaries, the witness said the focus was mainly on Kumar but admitted that there were other beneficiaries.

He cited an instance on January 8, 2019, where ₦2.5 million was transferred with the narration “Visco Business Solution / Ayodele Adedipe.”

PW9 further stated that he did not know the 1st defendant and had never seen any of the defendants before.

Counsel to the 3rd defendant, A.M. Aliyu, SAN, also cross-examined the witness.

With no further questions from counsel, Justice Anineh discharged PW9 from the witness box and adjourned the matter to February 10 and 11, as well as March 11 and 12, 2026, for continuation of trial.

News

EFCC V Yahaya Bello: Prosecution Witness Admits Limits of His Evidence

The Economic and Financial Crimes Commission (EFCC) witness (PW9), Mr. David Ajomah, a compliance officer of Sterling Bank Plc, on Friday admitted limits of his evidence against former Kogi State Governor Alhaji Yahaya Bello before a law court.

Ajomah disclosed this in his evidence during a re-examination being carried out by the Defence Counsel, Mr J.B Daudu (SAN) at the resumption of hearing of the case before justice MaryAnn Anenih of the FCT High Court, Abuja.

When proceedings in the ongoing trial resumed on Friday, the testimony of Ajomah under cross-examination substantially narrowed the scope of the prosecution’s case.

Ajomah, who appeared in court pursuant to a subpoena, testified that between January and August 2019, the account of Bespoque Business Solutions Limited received total inflows of ₦1.16 billion.

He told the court that the inflows were credited by the Kogi State Internal Revenue Service (KSIRS) as commission.

According to him, cash withdrawals within the same period amounted to ₦952.4 million, largely in tranches of ₦10 million.

Earlier in his testimony, the witness stated that between March and August 2019 alone, the account recorded inflows of ₦963.8 million. He also confirmed that cash withdrawals attributed to a named individual, Philip Kuma, totalled ₦835.9 million during the period under review.

Kemi Pinheiro, SAN,

While being led by the prosecution, Mr Kemi Pinheiro, SAN, the witness told the court that the pattern of cash withdrawals between January and August 2019 was consistent, contrasting sharply with transactions between July and December 2018.

He explained that during the earlier period, there were no inflows from the Kogi State Government or KSIRS and that cash withdrawals were minimal, mostly below ₦1 million. He further confirmed that debit entries prior to January 2019 were largely transfers rather than cash withdrawals.

The prosecution sought to link the transaction pattern to banking compliance obligations, with the witness explaining the concepts of Suspicious Transaction Reports (STR) and Cash Transaction Reports (CTR).

He told the court that a CTR is filed for cash transactions exceeding ₦5 million for individuals and ₦10 million for corporate entities, in line with Central Bank of Nigeria (CBN) regulations, while an STR is filed where transactions are inconsistent with the nature of a customer’s business.

However, under cross-examination, the defence exposed critical limitations in the witness’s evidence.

Mr. Ajomah admitted that he did not have the account opening documents for Bespoque Business Solutions Limited and therefore did not know the company’s directors or signatories.

He further conceded that he had no knowledge of the nature of the company’s business and that his testimony was limited strictly to the bank statement tendered as Exhibit AB1.

Defence counsel successfully established that without knowing the nature of the customer’s business, the witness could not conclusively determine whether the transaction pattern was unusual or suspicious.

The witness also confirmed that none of the cash withdrawals exceeded the ₦10 million limit prescribed by the CBN for corporate entities and that Sterling Bank honoured the withdrawals because they complied with regulatory requirements.

Crucially, Mr. Ajomah told the court that he had no evidence that any Suspicious Transaction Report was filed in respect of the transactions in question.

He also confirmed that none of the defendants, Yahaya Bello, Umar Oricha and Abdulsalami Hudu—appeared as beneficiaries in any of the transactions reflected in the bank statement.

He further stated that the name Abdulsalami Hudu did not appear in any transaction between July and December 2018.

After hearing Ajomah testimony, Justice MaryAnne Anenih adjourned the matter to Feb. 10 for continuation of hearing.

-

News1 year ago

News1 year agoKogi Police Prohibits, Warns Against Use of Vehicles With Covered Number Plates

-

News1 year ago

News1 year agoHow We Discovered Drugs In The Residence of Kwara Senator Accusing Us of Corruption. – NDLEA

-

News2 years ago

News2 years agoKogi Govt. Commences Staff Audit For State Civil Servants Dec. 5th

-

News2 years ago

News2 years agoNigeria’s Public Officials Received ₦721bn Bribe In 2023 – UN, NBS

-

Politics2 years ago

Politics2 years agoKOGI2023: AA’s Candidate, Braimoh, Promises To Regenerate State’s Economy, Receives Decampees

-

News3 years ago

News3 years agoSen. Smart Adeyemi Set To Kick-off N250M Empowerment Programs In Kogi West

-

News2 years ago

News2 years agoPDP Will Expel Wike At Appropriate Time – Bwala

-

News3 years ago

News3 years agoWAEC Releases 2022 WASSCE Results